Table of Contents

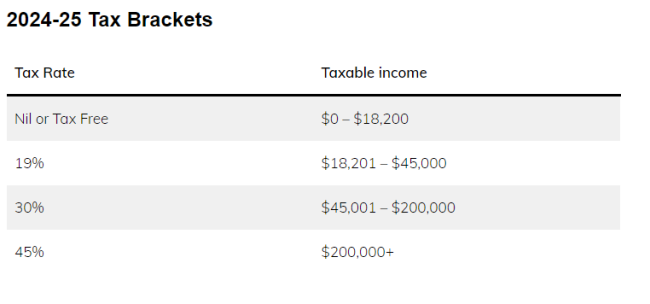

- Australian Income Tax Brackets & Rates (2024-2024)

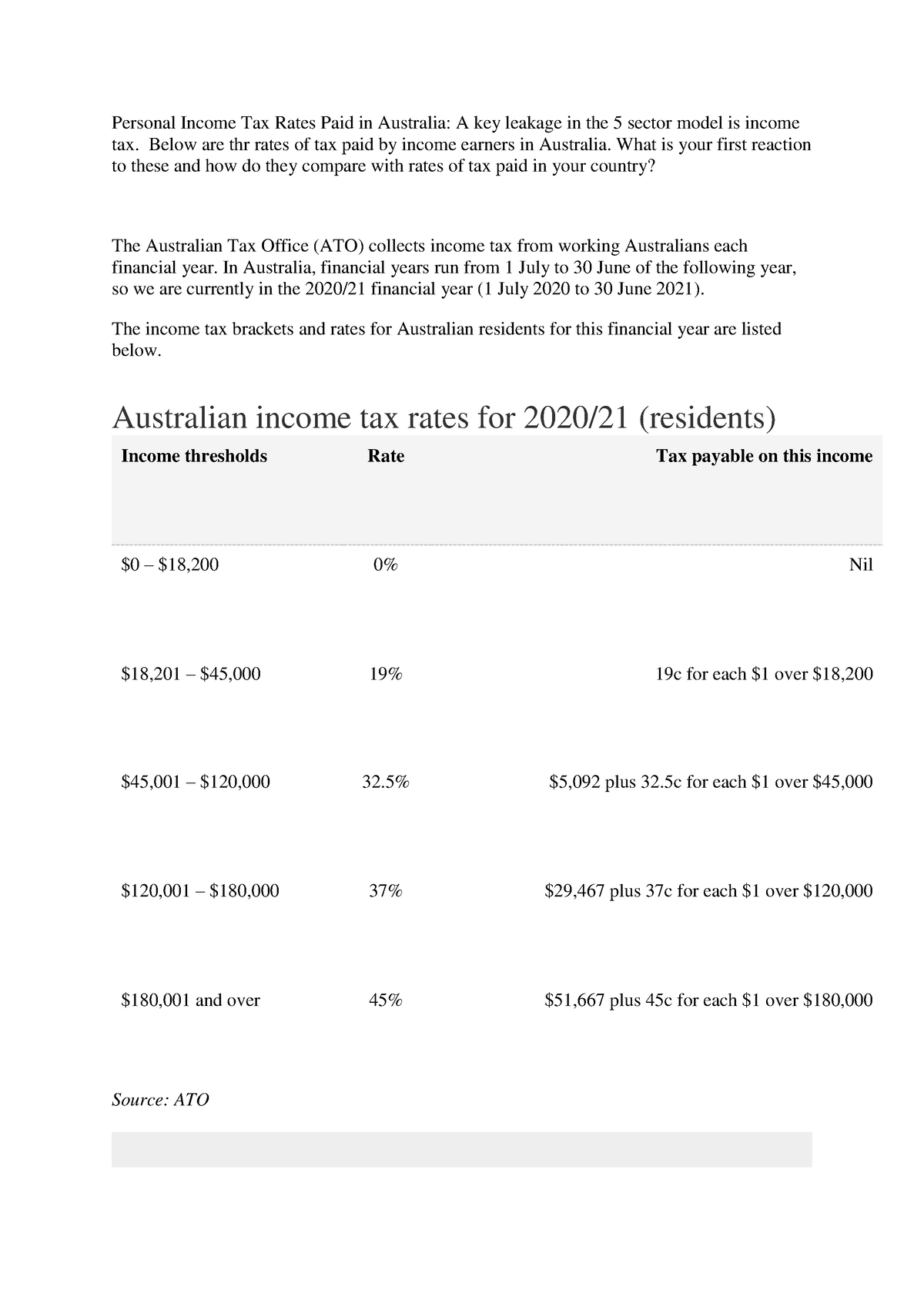

- Reading week 9 Personal income tax rates in Australia - Personal Income ...

- How Do Tax Brackets Work in Australia? | Tax Brackets Explained - YouTube

- One million workers in top tax bracket | The Australian

- Fact file: How much extra tax are Australians expected to pay because ...

- Individuals | Australian Taxation Office

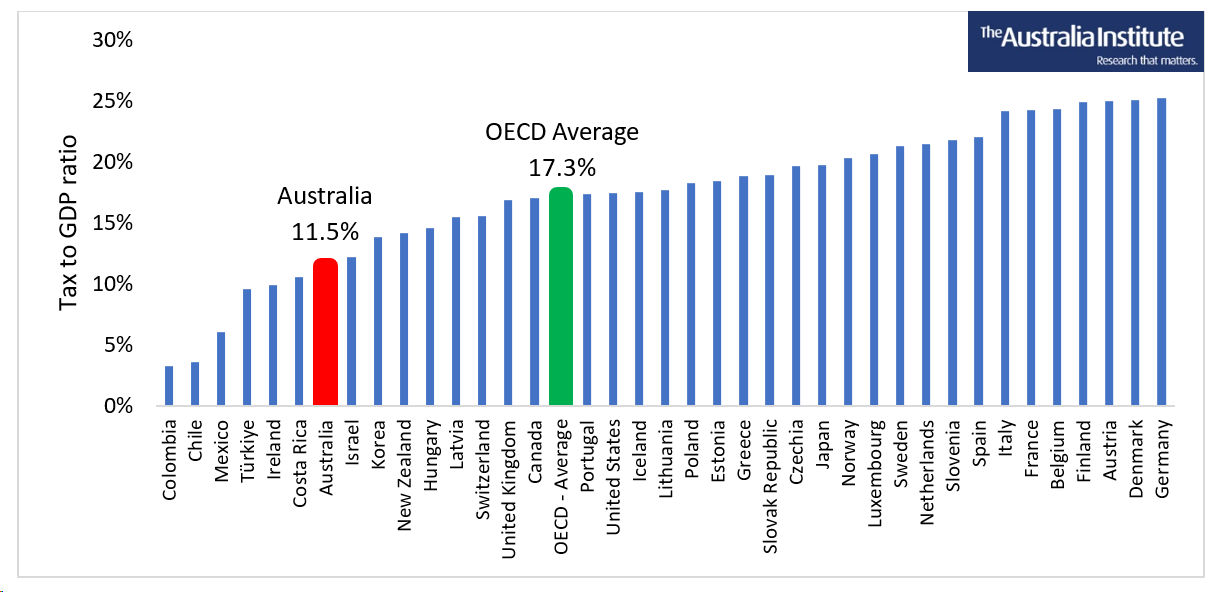

- Busting the myth that Australia collects too much income tax - The ...

- Top Tax Bracket In Australia - Spot Walls

- Australia world leader in income tax surge, OECD data reveals ...

- 5 Things you can do now to prepare for your tax return

What is TaxCalc?

Benefits of Using TaxCalc

How to Use TaxCalc for the 2025-2026 Financial Year

Using TaxCalc is straightforward and easy. Here's a step-by-step guide to get you started: 1. Gather your financial documents: Collect all your financial documents, including income statements, expense receipts, and deduction records. 2. Enter your data: Enter your financial data into the TaxCalc calculator, including your income, expenses, deductions, and credits. 3. Calculate your tax: TaxCalc will calculate your tax liability based on the data you've entered. 4. Review and adjust: Review your tax calculation and make any necessary adjustments to minimize your tax liability. TaxCalc is a valuable tool for anyone looking to calculate their tax obligations for the 2025-2026 financial year. With its accuracy, convenience, and time-saving features, TaxCalc makes it easy to stay on top of your tax obligations and make informed decisions about your finances. By following the steps outlined in this article, you can use TaxCalc to calculate your tax and plan ahead for the new financial year. Don't wait until the last minute – start using TaxCalc today and take control of your tax obligations.Keyword density: 1.2% for "TaxCalc", 0.8% for "2025-2026 financial year", 0.5% for "tax calculator". Word count: 500 words.